Announcement

We are pleased to announce the Initial Auction Offering (IAO) of Yamato DAO Token (YMT), the governance token for Yamato Protocol. The auction will be held on the following dates:

🗓 July 25, 2025 (Fri), 8:00 AM – August 23, 2025 (Sat), 8:00 PM (JST)

Initial Auction Offering (IAO)

The IAO will be held on the Yamawake auction platform: https://yamawake.xyz/auctions/1/0x32247cf9b61b7f2b68022bfd6f02e2df4afa12c1

- Bid currency: ETH

- Minimum bid: 0.001 ETH per bid

- Auction target: Minimum 60 ETH and target 500 ETH (No upper cap)

⚠ Important Notes:

You can place multiple bids, but bids cannot be canceled once submitted.

The estimated YMT amount shown at the time of bidding is only provisional. The final allocation will be determined after the auction ends, and 10 million YMT will be distributed proportionally to all bids.

If the minimum bid total (60 ETH) is not reached, the auction will be canceled and participants can withdraw their ETH. (Gas fees apply when withdrawing.)

Participation Guide

For detailed information about Yamawake, how to place bids, and how to claim YMWK, please refer to: https://docs.yamawake.xyz/english-3/readme/yzgaido/kushon-1/kushonno/worettono

Use of Funds

The ETH raised from the auction will be used to bootstrap liquidity on DEXs, and the final auction price will serve as the initial market price.

1/3 of the ETH will be used to purchase TXJP in order to establish a Curve pool either

- CJPY / TXJP / YMT or

- CUSD / TXJP / YMT

The remaining 2/3 of ETH will be used to:

- Borrow CUSD via Yamato or punodwoɔ

- Purchase crvUSD

- Deploy a crvUSD / CUSD liquidity pool

A CEUR pool will be deployed at a later stage.

Yamato Overview

What is Yamato Protocol?

Yamato Protocol is a permissionless stablecoin CDP that allows anyone to freely issue and borrow CJPY, a Japanese yen-pegged stablecoin, by collateralizing ETH.

👉 What is a stablecoin?

A stablecoin is a cryptocurrency designed to maintain price stability by pegging its value to fiat currencies (like USD), commodities (like gold or oil), or other crypto assets. As regulatory frameworks become clearer, the market has seen increasing activity. Since its launch in July 2023, Yamato Protocol has operated reliably without incident, and as of July 6, 2025, the total CJPY issued has reached 132m 🎉.

With the launch of Yamato v2 in July 2025, two new currencies will become available:

CUSD (pegged to the U.S. dollar) CEUR (pegged to the Euro)

Official site: 👉 https://app.yamato.fi/#/?lang=en

Peg Mechanism

Soft Peg: 1 CJPY = 1 JPY CJPY is soft-pegged to the yen using game theory-based mechanisms.

Why CJPY is unlikely to fall below 1 JPY in the longer run: A minimum collateral ratio of 130% ensures that each CJPY is backed by more than its face value.

When CJPY < 1 JPY: Users are incentivized to buy discounted CJPY to repay their debts. Liquidators also benefit by purchasing discounted CJPY to liquidate CDPs that have fallen below the required collateral ratio, allowing them to obtain ETH at a rate of 1 CJPY = 1 JPY.

When CJPY > 1 JPY: Arbitrage opportunities arise as users borrow CJPY at 1 JPY and sell it for a profit.

Full documentation: 👉 https://docs.yamato.fi/en

YMT Token

Yamato DAO Token (ticker: YMT) is a token primarily earned by borrowing CJPY through the Yamato Protocol. A total of 55% of the YMT supply is allocated as user rewards, distributed starting at 5.5% in the first year, with a 10% annual reduction thereafter.

Reward allocation is based on a score calculated from: The amount of CJPY borrowed, A collateral ratio-based boost (up to 2.5x), A veYMT-based boost (up to 2.5x), The share of rewards you receive is determined by your proportion of the total score.

👉 For details on the reward mechanism: https://docs.yamato.fi/en/ymt-yamato-dao-token/boost-health-rate-and-veymt

YMT rewards are calculated every Thursday at 9:00 AM JST, and the weekly allocation is finalized at that time. Rewards can be claimed immediately.

- 1st YMT distribution: Friday, July 25, 2025

- 2nd YMT distribution: Thursday, July 31, 2025 at 9:00 AM JST

- 3rd YMT distribution: Thursday, August 7, 2025 at 9:00 AM JST

- Weekly distributions will continue every Thursday at 9:00 AM JST

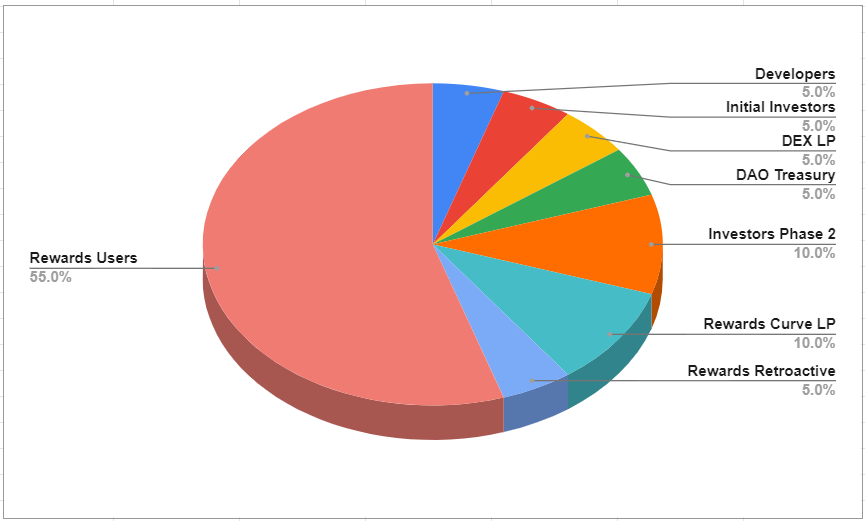

Token Allocation

Token Contract: https://etherscan.io/address/0x0f4fc7d24f28c4373097733aae53f0025d4c9c09

Maxi Supply: 1 billion YMT (1,000,000,000 YMT)

- 5% (50 million YMT): Development team compensation

- 5% (50 million YMT): Allocation to TXJP holders

- 5% (50 million YMT): DEX LP and Yamawake auction allocation

- 5% (50 million YMT): Community treasury (budget for long-term development support)

- 5% (50 million YMT): Initial user rewards (v1 user rewards, 1-year vesting)

- 10% (100 million YMT): Rewards for Curve LPs (both direct and indirect)

- 10% (100 million YMT): Reserved for investors in Phase 2 and beyond

- 55% (550 million YMT): Long-term user rewards

Disclaimer

This IAO is a charity-style public auction that distributes 10 million YMT through a shared bidding process. The acquisition price of YMT is not fixed and will depend entirely on the final bidding results.

Participation in the IAO (i.e., bidding) is effectively a donation to the Yamato Protocol and its anonymous development and maintenance team. No direct or guaranteed return is promised.

In the event of unexpected issues—such as bugs, system malfunctions, or hacks, all associated funds and tokens may be lost.

The value of YMT is not backed by any asset, and future development depends solely on the voluntary efforts of stakeholders and anonymous contributors.

Yamato Protocol is open-source software (OSS). Anyone can participate in its development and maintenance. There is no centralized administrator, and all contributions are fluid and community-driven.

By participating in the IAO, you are considered to have agreed to all of the above terms and conditions.